World Energy Investment 2022

This year’s edition of the World Energy Investment report provides a full update on the investment picture in 2021 and full-year estimates of the outlook for 2022. It examines how investors are assessing risks and opportunities across all areas of fuel and electricity supply, critical minerals, efficiency and research and development, against a backdrop of uncertainties over how events will play out in 2022, namely the ongoing war in Ukraine, the outlook for the global economy, and in some countries the continuing public health risks from the pandemic.The report focuses on some important features of the new investment landscape which are already visible, including the energy security lens through which many investments are now viewed, widespread cost pressures, the major boost in revenues that high fuel prices are bringing to traditional suppliers, and burgeoning expectations in many countries that investments will be aligned with solutions to the climate crisis.

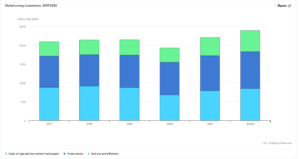

Energy investment is set to pick up by 8% in 2022 against the backdrop of the global energy crisis, but almost half of the increase in capital spending is linked to higher costs

High prices, rising costs, economic uncertainty, energy security concerns and climate imperatives amount to a powerful cocktail of factors bearing on global energy investment

Investment is central to tackling the multiple strands of today’s energy crisis: to relieve pressure on consumers, to get the world on a net zero pathway, to spur economic recovery, and – for Europe in particular – to reduce reliance on Russia following its invasion of Ukraine. Governments, companies and investors face a complex situation as they decide which energy projects to back, with urgent short-term needs not automatically aligned with long-term goals. A lot is riding on these choices.

Our updated tracking, across all sectors, technologies and regions, suggests that world energy investment is set to rise over 8% in 2022 to reach a total of USD 2.4 trillion, well above pre-Covid levels. Investment is increasing in all parts of the energy sector, but the main boost in recent years has come from the power sector – mainly in renewables and grids – and from increased spending on end-use efficiency. Investment in oil, gas, coal and low-carbon fuel supply is the only area that, in aggregate, remains below the levels seen prior to the pandemic in 2019. This is despite sky-high fuel prices that are generating an unprecedented windfall for suppliers: net income for the world’s oil and gas producers is set to double in 2022 to an unprecedented USD 4 trillion.

Almost half of the additional USD 200 billion in capital investment in 2022 is likely to be eaten up by higher costs, rather than bringing additional energy supply capacity or savings. Costs are rising due to multiple supply chain pressures, tight markets for specialised labour and services, and the effect of higher energy prices on essential construction materials like steel and cement.

These cost pressures are most visible in fuel supply, but are affecting clean energy technologies as well: after years of declines, the costs of solar panels and wind turbines are up by between 10% and 20% since 2020. Concerns about cost inflation are a brake on the willingness of companies to increase spending, despite the strong price signals.

Easing the burden on consumers is an immediate priority for many policy makers: the total energy bill paid by the world’s consumers is likely to top USD 10 trillion for the first time in 2022, hitting the poorest parts of society the hardest and putting pressure on governments to cushion the blow via fiscal measures and price interventions.

High prices are encouraging some countries to step up fossil fuel investment, as they seek to secure and diversify their sources of supply. However, the lasting solutions to today’s crisis lie in speeding up clean energy transitions via greater investment in efficiency, clean electricity and a range of clean fuels. These elements are central, for example, to the European Union’s REPowerEU plan to reduce reliance on Russia. There are many ways to respond to the immediate energy crisis that can pave the way to a cleaner and more secure future.

Source: IEA