How to navigate the headwinds in the renewable energy supply chain

The renewable energy supply chain is under pressure, with massive consequences for project developers. Demand for equipment is surging for everything from wind turbines to solar PV modules and hydrogen electrolyzes-and the supply gaps are widening.

In 2022, the global net capacity additions for renewables are expected to reach almost 320 GW–a more than 60 percent rise in yearly additions since 2019. By 2030, this increase is expected to reach between 500 GW and almost 1,200 GW per year. For comparison, the entire global renewable capacity installed over the past decades stands at about 3,000 GW. The picture looks starker for hydrogen: hundreds of gigawatts of electrolyzers are needed from today’s baseline of near-zero demand.

Commodity markets are pouring even more fuel on the fire. Driven by price spikes, oil and gas companies are set to create almost $1 trillion in free cash flow in 2022. This windfall provides the capital needed to finance own renewable ambitions, with some companies targeting more than 100 GW buildouts by 2030. Finally, the US Inflation Reduction Act and Europe’s REPowerEU plan have set ambitious targets and provided hefty incentives, such as a tax credit of up to $3 per kg for low-carbon hydrogen, likely driving incremental capacity additions across low-carbon energy sources.

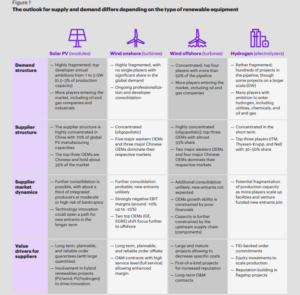

Using the Kearney Purchasing Chessboard, supply and demand dynamics provide a valuable indicator for which supply chain strategy project developers should pursue (see figure 2). While demand power can be company-specific (think a multi-GW global utility versus a 100 MW independent developer), an industry average view showcases the big picture. Offshore wind turbines and electrolyzers are in the top-right quadrant of the Purchasing Chessboard, where both demand and supply power are high. Meanwhile, onshore wind and PV are under threat of moving farther toward the upper left–the most unfavorable combination of market forces from a buyer’s perspective, where demand power is low and supply power is high.

Source: KEARNEY