Cost of New Renewables Temporarily Rises as Inflation Starts to Bite

Supply-chain woes push up cost of new-build solar, battery storage and onshore wind, which rises between 4% and 14% from year ago

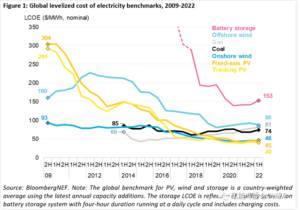

The cost of new-build onshore wind has risen 7% year on year, and fixed-axis solar has jumped 14%, according to the latest analysis by research company BloombergNEF (BNEF). The global benchmark levelized cost of electricity, or LCOE, has temporarily retreated to where it was in 2019. Cost rises are linked to increases in the cost of materials, freight, fuel and labor.

BloombergNEF’s estimates for the global LCOE for utility-scale PV and onshore wind rose to $45 and $46 per megawatt-hour (MWh), respectively, in the first half of 2022. Despite losing some ground, this still marks an 86% and 46% reduction since 2010 in nominal terms. Global benchmarks conceal a range of country-level estimates that vary according to market maturity, resource availability, project characteristics, local financing conditions and labor costs. The cheapest renewable power projects in the first half of 2022 were able to achieve an LCOE of $19/MWh, as in best-in-class onshore wind farms in Brazil, and $21/MWh for tracking PV farms in Chile, and $57/MWh for offshore wind in Denmark. If the offshore transmission costs are excluded, the latter estimate falls to $43/MWh.

Despite temporary cost rises for renewables, the gap to fossil fuel power generation continues to widen due to fuel and carbon prices rising even faster. New-build onshore wind and solar projects are now around 40% lower than BNEF’s global benchmarks for new coal- and gas-fired power. The latter cost at $74 and $81 per MWh, respectively.

While demand for low-carbon technologies in the energy sector bounced back strongly in the second half of 2021, supply has struggled to keep up. Global supply chains were weakened by investment deferrals, staff layoffs, early retirement of assets and lockdowns. Trade flows have been disrupted by challenges in logistics and transportation, trade barriers, and a re-wiring of relationships following Russia’s invasion of Ukraine.

Shipping rates from Asia have fallen from their peak in September 2021 but are still five times higher than in 2019. Shipping routes from Asia are critical to deliver solar panels, inverters, batteries and other components. More recently, labor costs started to rise. In the US, labor costs 16% more than 18 months ago. Since February 2022, the price of key metals, including aluminum, copper, cobalt and molybdenum has dropped, but remains relatively high.

Amar Vasdev, a co-author of the report at BNEF, commented: “These cost hikes mark a rough patch for renewables, but not an inflection point. We see a return to long-term technology cost decline trajectories as demand continues to be strong, supply chain pressures ease and production capacity, particularly in China, comes back online.”

The battery storage sector is particularly sensitive to commodity price volatility. Our battery LCOE benchmark sits at $153/MWh today, up 8.4% compared to 1H 2021. Prices for lithium carbonate, one of the key inputs for lithium-iron-phosphate (LFP) battery systems, surged 379% over the past year. Materials hedging for projects commissioned in 1H 2022 is delaying the impact of rising material costs. BNEF’s sensitivity analysis shows that system costs subject to 2022 commodity prices should be 22% higher year-on-year at $323/kWh in June 2022, compared with $264/kWh in June 2021. However, projects commissioned over the last six months would have likely hedged their supply during 2021, before the steep rise in material costs.

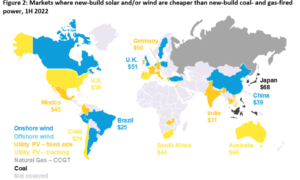

Renewables remain the cheapest source of new bulk power in countries comprising two-thirds of the world population and nine-tenths of electricity generation.

David Hostert, global head of economics and modeling at BloombergNEF said: “Low-carbon technologies may be insulated from an economic downturn, but they are not isolated. There is also a risk that lesser-developed economies will be disproportionately affected by price hikes. Leading up to COP27 in Egypt in November, extra attention should be paid to these markets as it will be crucial to make sure they don’t fall behind and lose valuable time in the race to net zero.”

Source: BNEF