Latest Trends of European Energy Policy

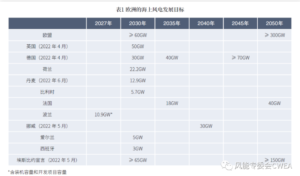

In March 2022, the European Commission formulated a new EU energy policy “REPowerEU”, which aims to improve the independence of European energy and rapidly reduce dependence on Russian fossil fuels (reduce Russian natural gas imports by 2/3 in 2022 and completely terminate in 2027). On May 18, the European Union announced the “REPowerEU” action plan, which plans to increase investment in new energy infrastructure and systems [210 billion euros (about 1446.333 billion yuan) before 2017], and carry out work in three areas: energy conservation, accelerating clean energy and energy diversification. At the same time, the European Commission proposed to increase the proportion of renewable energy in the EU from 40% to 45% by 2030. As part of the “REPowerEU” plan, the strategy aims to increase the cumulative installed capacity of wind power to 480GW by 2030, make the installed capacity of solar photovoltaic power generation exceed 320GW by 2025, more than twice the current level, and approach 600GW by 2030. This can also be said to be the new energy security strategy of Europe. With the new legislation, it will reflect the new principle of the EU that expanding renewable energy is an overriding public interest issue, and require governments to quickly determine the preferred regions for deploying wind power and solar power.

In June 2022, the European Commission released its “Nature Protection Package”. It follows the EU’s 2030 biodiversity strategy and is part of the European Green Deal. In the plan, the European Commission proposed a new binding law, setting the goal of restoring 20% of Europe’s land and marine nature reserves to avoid the loss of Europe’s biodiversity. It is closely related to “REPowerEU” and aims to maintain a good dynamic balance between the expansion of renewable energy and natural conservation.

For a long time, the European wind power industry has focused on cost reduction, and the bidding of new projects is based on price. In January 2022, the European Commission officially implemented the new Guidelines for National Assistance in Climate, Environmental Protection and Energy (CEEAG), allowing up to 30% of the scores in the auction of price difference contracts to be based on non price criteria. The Netherlands has widely used non price standards in the auction of the Hollande Kust West project (with a total installed capacity of no less than 1.4GW), which was launched in April this year. Among them, in the auction of Area 6, the focus is on how the project will affect the ecosystem of the North Sea, covering how the project will limit the negative impact of bird and marine habitat, and the score of relevant parts accounts for 50% of the total score; In the bidding of Area 7, more attention was paid to the integration of wind power projects with the Dutch energy system, and the score also accounted for 50%. France recently used a 25% non price scoring standard when auctioning 1GW offshore wind power projects near Normandy. The German government has proposed to use four non price criteria in its new offshore wind auction. Belgium is also consulting on a broad set of scoring criteria.

On May 11 this year, Norway announced that its offshore wind power development goal is to allocate 30GW of installed capacity by 2040, which will generate almost as much electricity as the total electricity consumed by the country today. At present, Norway has identified two development areas and plans to auction 1.5GW of floating wind power projects in one of them in 2023. The Norwegian government is working to identify other development areas and simplify the licensing process for offshore wind projects. At the same time, the Norwegian government said that it would explore “various grid solutions”. Cables with two-way power flow will be considered for each project deployment to strengthen power interconnection with other North Sea countries, strengthen power mobility and ensure energy security in Europe.

Source: CWEA